Financial Plan & Investment Packages

We are working on securing capital toward the establishment of this Draper Road Provisions & The Library Cafe business through a combination of our owner investment, investment from multiple private investors, and a term bank loan. Our current business plan and related capitalization plan is based the assumption that we lease the real estate at Draper Road for the business to operate at. The capital associated with this business plan is primarily for leasehold improvements, equipment and furniture, starting inventory, working capital and general corporate uses.

The lease we have for the property provides options (now or later) for us to acquire the real estate. Should we elect to acquire real estate, we envision a model whereby we utilize a separate entity (Draper Road Purveyors LLC) that would acquire the real estate and then lease it to our operational entity. It is contemplated that any individuals participating in the operational investment (the one outlined in this document) could review that offering and elect to participate in it at that point in time, should it occur.

As part of the financial strategy, we are seeking funding from investors and a bank to fund leasehold improvements, equipment and furniture, starting inventory, working capital and general corporate uses.

Currently we are focused on raising up to $1.0 million in private investment in $50,000 units to get the venture up and running and open for business. We are targeting a Q1 26 opening.

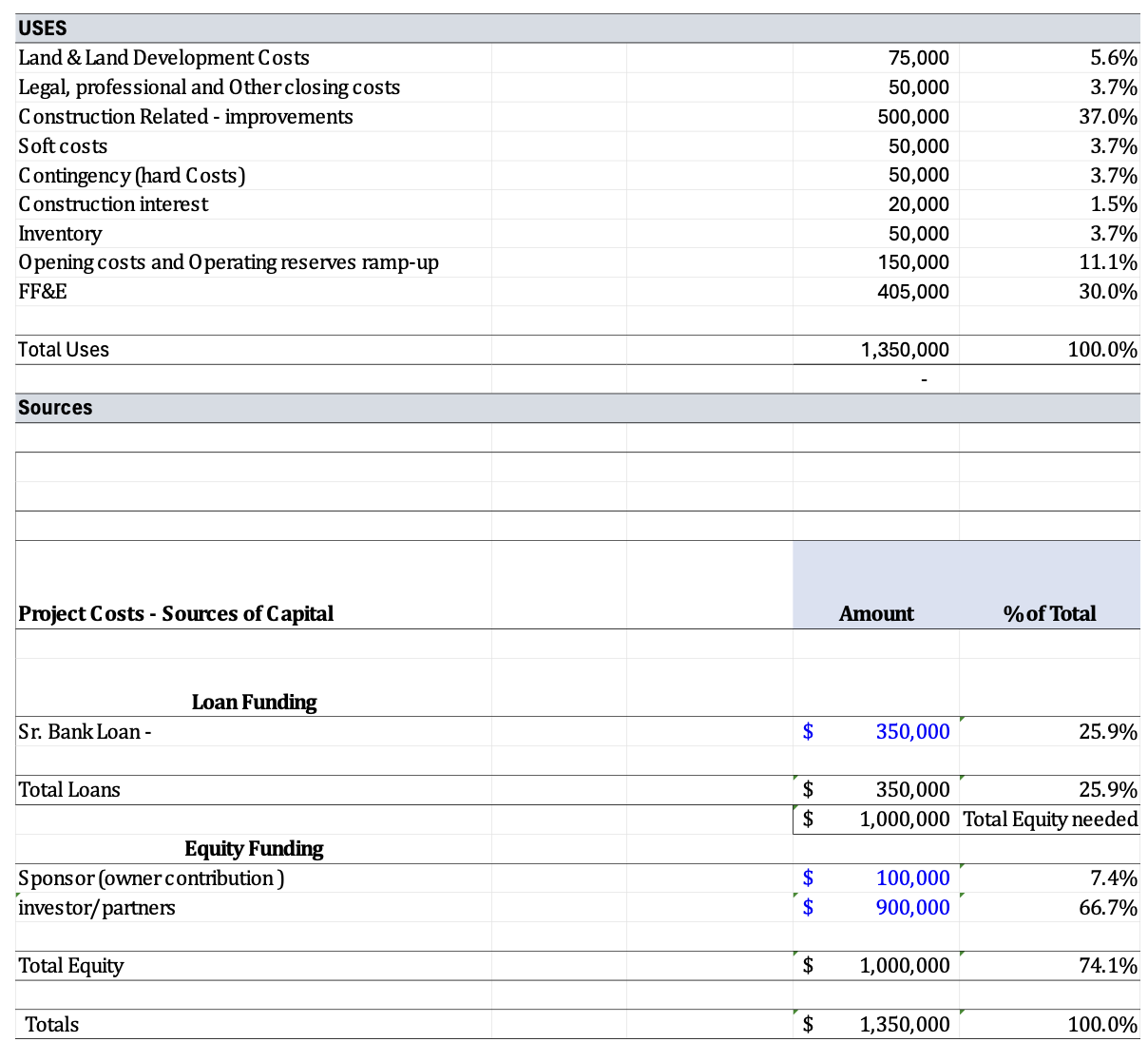

The following summarizes the planned sources and uses:

For those of you that know Katie and I personally, or those others we have already talked to directly about this venture, please do understand that an investment in Draper Provisions & The Library Cafe is about 1) seeking a return on your investment and 2) about supporting local entrepreneurs and being an active player in helping transform our small town into a much more cosmopolitan place with shopping, dining and entertainment options that we all desire. We will continue to push forward to that cosmopolitan future, and we hope you all want to join us! Here is how:

The Ask:

Raise Amount:

Up to $1,000,000 in capital for the lease-hold improvements, start-up uses, and other general corporate purposes, through a preferred stock (or equivalent) offering.

The offering contemplates a preferred equity class of shares.

Minimum investments are $50,000.

Additional capital is assumed to come from a bank lender

Additional details are included in the term sheet. If you are interested in fuller detail, please feel free to download our Series A Term sheet below:

TERM SHEET, COMPLETE 5-12-25

Next Steps: If you are interested in proceeding to purchase Series A Shares, please contact John Boyer, President, for additional details, documents, and next steps. All offers and sales of the Series A Shares will be made only by John Boyer, President, on behalf of the Company.